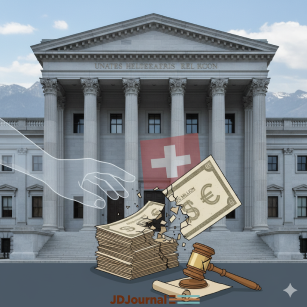

A New York federal court has rejected a $370 million lawsuit brought by investors in Credit Suisse’s Additional Tier 1 (AT1) bonds, ruling that Switzerland cannot be sued in the United States due to sovereign immunity protections. The Swiss government welcomed the ruling, emphasizing that the decision aligned with its long-held legal stance.

The outcome marks a significant setback for bondholders who sought compensation after their AT1 securities were wiped out during the 2023 government-brokered takeover of Credit Suisse by UBS, one of the most consequential banking rescues in modern European financial history.

The Roots of the Dispute: Credit Suisse’s Collapse

In March 2023, Credit Suisse faced a severe crisis of confidence following years of scandals, risk management failures, and client outflows. To prevent systemic collapse, the Swiss government engineered an emergency takeover by UBS. As part of that rescue, regulators at the Swiss Financial Market Supervisory Authority (FINMA) ordered the write-down of approximately $17 billion worth of AT1 bonds, a category of high-risk debt instruments designed to absorb losses in times of financial stress.

The controversial decision effectively wiped out bondholder investments while still preserving some value for equity shareholders—an inversion of the traditional hierarchy of claims in corporate insolvency, where shareholders typically absorb losses before debt holders.

For many institutional and retail investors, this reversal was both shocking and financially devastating. It triggered lawsuits in multiple jurisdictions, including Switzerland, the United Kingdom, and the United States.

The New York Lawsuit

The dismissed case in New York was filed in June 2024 by a group of U.S. bondholders who collectively sought $370 million in damages. Their claim asserted that Switzerland’s actions violated property rights and international legal standards by unfairly extinguishing their holdings.

The plaintiffs argued that by orchestrating the write-off and benefiting domestically while foreign investors suffered, Switzerland had engaged in unlawful conduct for which it should be held accountable in a U.S. court.

Switzerland, however, contested the lawsuit immediately, invoking the doctrine of sovereign immunity—a principle under international law and the U.S. Foreign Sovereign Immunities Act (FSIA) that generally shields foreign governments from litigation in American courts unless specific exceptions apply.

Court Ruling: Sovereign Immunity Prevails

The New York court sided with Switzerland, holding that the Swiss state was immune from the bondholders’ claims. According to the ruling, the plaintiffs failed to demonstrate that Switzerland’s actions fell within any FSIA exceptions, such as those involving commercial activity conducted in the United States.

Because the AT1 bond write-off was executed as part of Switzerland’s regulatory and governmental role in stabilizing its financial system, the court determined that it was a sovereign act, not a commercial one.

As a result, Switzerland cannot be forced to defend itself in U.S. courts over the bondholder losses.

The Swiss Finance Ministry issued a statement praising the judgment:

“The court’s decision confirms Switzerland’s legal position. The government acted within its sovereign authority to safeguard financial stability during an extraordinary crisis.”

Bondholders, however, have been given 30 days to appeal the decision, though legal experts note that overcoming sovereign immunity is notoriously difficult.

Why AT1 Bonds Were Targeted

AT1 bonds, also known as “contingent convertible bonds” (CoCos), were introduced after the 2008 global financial crisis as a mechanism to help banks raise capital while ensuring that investors, not taxpayers, would absorb losses in a crisis.

These securities typically carry higher yields but come with unique risks: regulators can order them to be converted into equity or written down entirely if a bank falls into distress.

The Credit Suisse case highlighted how such mechanisms can lead to unexpected investor losses, particularly when regulators take extraordinary measures in times of systemic risk.

Global Legal Fallout

Although the U.S. court ruling represents a victory for Switzerland, the legal battles are far from over. Several other lawsuits are pending:

- In Switzerland: AT1 investors are challenging FINMA’s decision directly, arguing that the bond write-downs were unlawful under Swiss law.

- In the U.K. and elsewhere: International investors have launched claims in their home jurisdictions, hoping to sidestep Swiss legal protections.

- Against UBS: Some lawsuits focus on alleged misrepresentations by UBS and Credit Suisse’s former leadership leading up to the collapse.

In July 2025, a separate U.S. court ruled that UBS must face certain investor claims over alleged misconduct tied to Credit Suisse’s demise, ensuring that litigation related to the 2023 crisis will continue for years.

Implications for Investors and Regulators

The dismissal of the U.S. case underscores the high hurdles investors face when suing sovereign governments abroad. Unless clear commercial activity in the U.S. can be proven, courts are generally reluctant to pierce sovereign immunity protections.

For global investors, the ruling is a reminder of the unique risks of AT1 instruments. While offering attractive returns during stable times, these bonds come with built-in provisions that allow regulators to shift losses to investors during turmoil.

From a regulatory perspective, the Credit Suisse episode will likely fuel ongoing debates about the balance between financial stability and investor protections. While Switzerland defended its actions as necessary to prevent a wider financial collapse, the bondholder community argues that the measures undermined market trust in bank capital instruments.

Looking Ahead

Bondholders now face a difficult decision: whether to pursue an appeal in the United States, continue pressing claims in Europe, or accept their losses. Given the legal shield of sovereign immunity, prospects for success in U.S. courts appear slim.

Still, the litigation has already raised important questions about accountability in cross-border financial crises. Should governments be able to wipe out investors with no recourse? Or do investors assume these risks when buying AT1 instruments?

For now, Switzerland stands firm, buoyed by a U.S. court ruling that reinforces its immunity and validates its emergency measures during one of the most tumultuous banking rescues in recent history.

Stay ahead of the curve in today’s fast-changing legal landscape. Cases like the Credit Suisse AT1 bond dispute highlight how international finance, regulatory law, and litigation continue to reshape the profession. If you’re an attorney or legal professional looking to expand your career, LawCrossing gives you access to the most comprehensive database of legal jobs in the nation.